Happy Friday everyone!

If you’re one of the hundreds of new investors to join us from Wealth Mastery - welcome.

I recorded a Zoom session for Wealth Mastery graduates just like yourself with answers to dozens of questions around investing, how to get started, how to act on Peter Diamandis’ recommendations etc. which you can find here.

And if you’ve been with me for a while, you’ll notice a slightly new format today.

Going forward, every two weeks, you’ll receive an Alert - detailing a specific opportunity with 10X upside - in business, investing, or lifestyle design.

I’m doing this to make this newsletter more actionable. More value, less fluff.

My goal is to help you act on opportunities in the new economy - on the edge of where technologies evolve exponentially, sovereign nations rise and fall, fortunes are made, and clever countries compete for remote workers.

My promise to you is to make these Alerts simple, accessible, actionable - and timely.

And what more timely Alert than one on Ethereum.

Ethereum is making a new all-time high today at $2,780 - and for good reason.

Today I’ll explain why - and how you can get in on the action.

So let’s dive right in.

🔥 Here’s what you’ll learn today:

Why should you care about Ethereum?

What the hell is Ethereum?

What problem is it trying to solve?

Why did it just reach an all-time high price of $2,780?

Top resources for more information

How to buy Ethereum

(📈PRO): How should you value Ethereum?

(📈PRO): Ethereum price prediction 🔮

(📈PRO): When should you sell your Ethereum?

(📈PRO): How much money should you allocate to Ethereum?

(📈PRO): The safest places to store Ethereum

(📈PRO): How to buy Ethereum directly in your brokerage account

(📈PRO): How to earn interest on your Ethereum (up to 30% per year)

💡 Why should you care about Ethereum?

Ethereum was launched in July 2015 and has since become the second-largest cryptocurrency in the world.

It has the potential to transform the face of the Internet over the next decade.

But it’s also one of the best-performing assets of the last 6 years.

If you had bought $1,000 worth of Ethereum at its launch in 2015 - you’d have a cool $1 million today.

That being said, Ethereum still has a long way to go. As of April 2021, it is still one of the most interesting investment opportunities in the world.

🤷 Ok - so what the hell is Ethereum?

Ethereum is a software platform that has 2 main uses:

To support the world’s second-largest cryptocurrency - Ether (more on Ether in a second)

To be the infrastructure platform that powers applications that everyone can use and no one can take down - which is now possible with blockchain technology.

It was built by a 19-year old Canadian/Russian genius called Vitalik Buterin - and is worth $300 billion today.

In perspective, that’s bigger than companies like Nike and Coca-Cola (and bigger than the economy of Finland).

⭐ But first - what’s the difference between bitcoin and Ethereum?

Bitcoin is a digital store of value. For all intents and purposes, you can look at bitcoin as digital gold. Its value is derived mainly from its:

scarcity (there will only ever be 21 million bitcoin)

durability (it’s software)

portability (it can be sent anywhere in the world like an email)

divisibility (you can buy 0.00000001 bitcoin)

counterfeit difficulty (has not occurred to date)

In contrast, gold is less scarce, is difficult to move and divide into small units, and expensive to store.

Ethereum, on the other hand, is a network that powers decentralized applications using Ether, its native cryptocurrency.

If Bitcoin is digital gold, you can think of Ethereum as digital oil.

If the current world economy runs on oil, the digital economy could run on Ethereum.

If more applications are built on top of Ethereum - and need Ether to be executed - then the Ethereum network will be more valuable.

🔍 What problem does Ethereum solve?

Bitcoin and Ethereum were built with similar principles in mind - to remove intermediaries.

Intermediaries are everywhere - and behind the scenes, they help us accomplish all sorts of tasks.

For example, Gmail helps you send emails. Your bank helps you send money. Instagram helps you send content to thousands of people. And Uber helps you order a car.

But using intermediaries presents three major obstacles:

Our personal (and financial) data is stored on the servers of companies like Google, HSBC or Facebook which are vulnerable to leaks, hacks, resale, etc.

Intermediaries can censor our access to their services

It’s inefficient and costly

The goal of Ethereum is to give users more power over their personal data and replace intermediaries with smart contracts that automatically execute rules.

Ethereum aims to ensure that if a specific rule is met in a transaction, the transaction is automatically executed - and cannot be censored or slowed down by inefficiencies.

🚗 Take Uber, for example

Today, Uber takes a fee for processing the payment between the driver, Uber and the customer - and for facilitating the actual ride.

Uber also depends on a payment processor (which charges high fees) to process payments between the rider, Uber and the driver.

In the future, smart contracts run on the Ethereum network would allow the payments of the ride to be executed automatically.

This will make transactions cheaper, more efficient and automated.

To be executed, every transaction needs a little bit of Ether.

As a result, as the Ethereum network is increasingly used, the need for Ether increases, which pushes up its price.

This means Ether and Ethereum aren’t exactly the same thing (Ether is a currency, Ethereum is a platform) but for the sake of simplicity, most people (and this Alert) use them interchangeably.

Ethereum is a platform anyone can use to create digital applications. It wants to become the world computer on which a new system is built.

Only 6 years after its launch, it’s become the go-to software for people building the new world of decentralized finance - including the famous NFTs you hear about in the news.

🚀 Why did Ethereum just reach an all-time high of $2,780?

These days, Ethereum is on fire 🔥

During all of last year, Ethereum settled $1.3 trillion in transactions. In the last quarter alone, it settled $1.5 trillion.

Remember, Ethereum transactions require Ether to be executed - so the more transactions are required to be executed, the higher the demand for Ether will be.

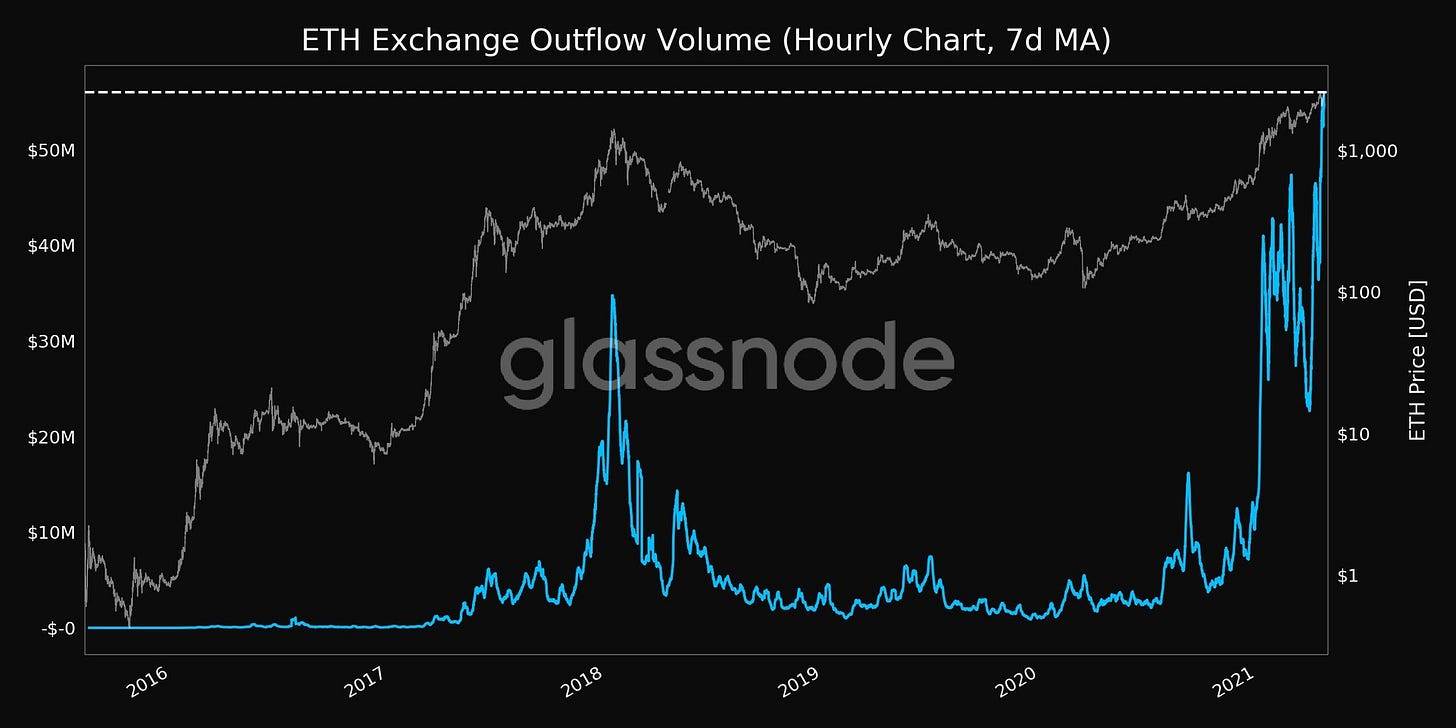

Ethereum outflows from exchanges are reaching an all-time high

This means people are using Ethereum in decentralized finance to back loans, buy NFTs, stake it, swap tokens, etc. and taking self-custody of their money.

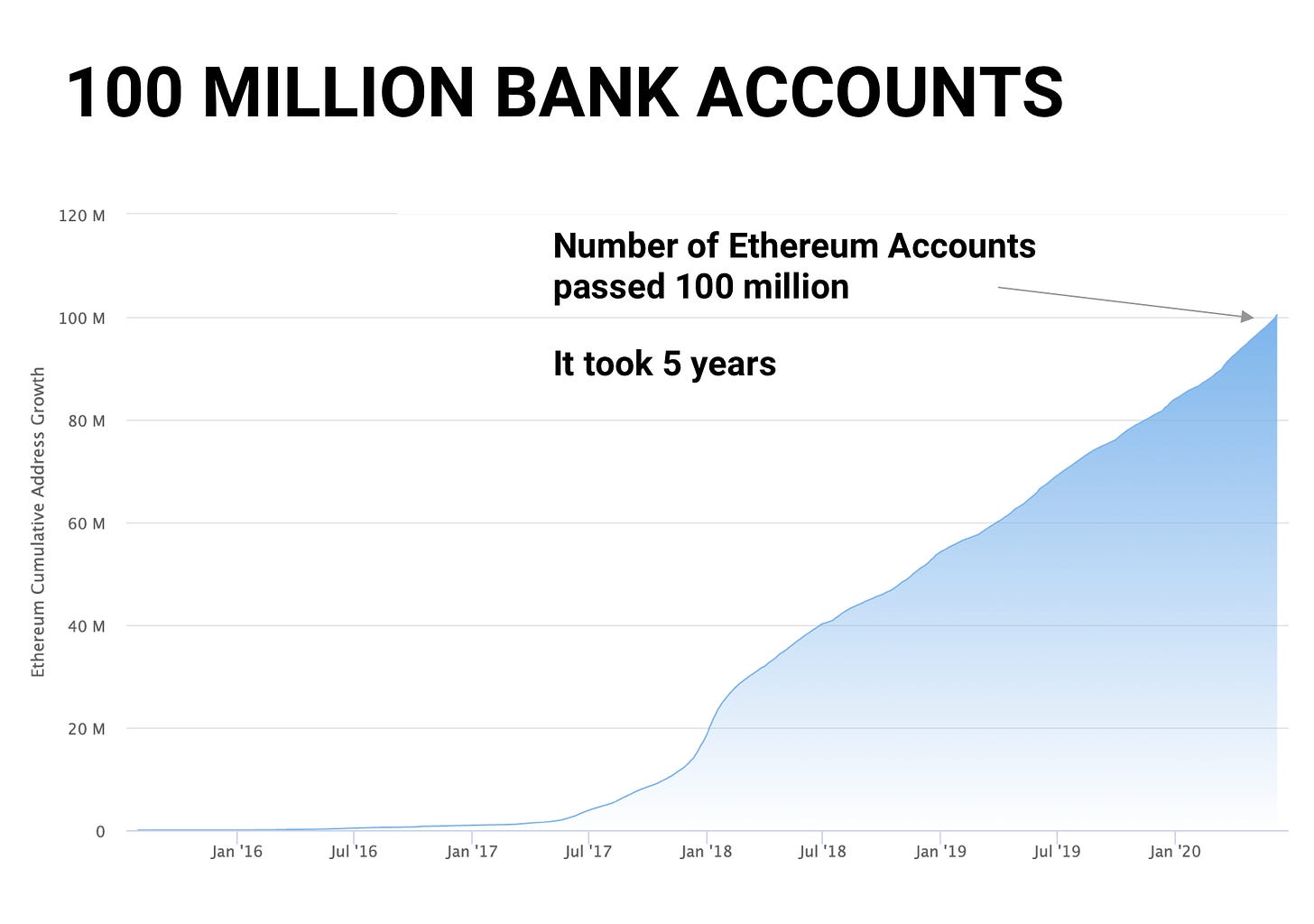

Active Ethereum addresses are reaching an all-time high.

The number of people holding Ethereum is skyrocketing - and Ethereum is increasingly being used as a crypto native bank accounts.

🧨 So… why Ethereum NOW?

Ethereum is at a critical crossroad that is likely to push up the price of Ether substantially in the next 18 months.

Here’s why:

Investors can earn up to 25%+ interest per year on their Ether (on top of the capital appreciation) by using decentralized financial platforms. This will likely incentivize more people to buy and hold Ethereum.

(I explain how you can do the same in the Pro version of this alert.)

Ethereum is about to undergo a big update in July and another one later this year.

One of these upgrades will take a large amount of Ethereum out of circulation for a while - which will likely push up the price of Ethereum simply on decreased supply.

(To keep it simple, I will not cover the specific details of these upgrades here - but if you want to do your own research, these are upgrades to something called EIP1559 and the migration to proof-of-stake).

Institutional investors will be faster to adopt Ethereum than bitcoin because the initial hurdles of investing in digital assets will already have been cleared with bitcoin.

The story of Ethereum’s future is spreading fast. As Ethereum increases in value relative to bitcoin, more people will notice, which will feed a frenzy of buying.

This is already happening thanks to skyrocketing number of transactions, active addresses, and exchange outflows.

The increased performance and use of Ethereum are likely to keep driving prices (way) up.

🔗 Top resources to learn more

For a deep-dive on Ethereum with founder Vitalik Buterin, check out this podcast with Lex Friedman and this one with Tim Ferriss.

For updates on Ethereum (and Decentralized Finance in general), check out this newsletter.

To understand what the future of finance looks like, watch this video.

And to better understand what Ethereum is likely to become after the next upgrades, check out this link.

If you want to learn how to actually code Ethereum, I encourage you to check out Crypto Zombies, an official coding course endorsed by the Ethereum foundation to learn the basics of its programming language, Solidity.

Lastly, if you want to read the entire story of Ethereum and how it came to be, I can highly recommend this book that I personally loved.

💰 How to Buy Ethereum

The easiest way to buy Ethereum is to create an account on a cryptocurrency exchange like Kraken, Coinbase or Binance and fund it through a bank transfer.

Once you are in possession of your Ether, you can either keep it in a vault on the exchange, transfer it to a digital wallet like Exodus, or a hardware wallet like a Ledger Nano S or Trezor.

The difference between the three options comes down to a) trust and b) risks.

On the one hand, keeping your crypto on a regulated exchange removes the need for you to store it yourself. A lot of people lose their crypto because it isn’t stored properly.

Storing your crypto yourself in a wallet will require you to write down and store a backup password.

If anyone were to find the password in your house, they could take all your crypto (and if your house catches fire or faces a natural disaster, you could lose your backup password too).

On the other hand, leaving your crypto on an exchange makes it prone to hacks.

That being said, some exchanges have never been hacked at all - and offer perfectly safe places to store your crypto.

At the end, the decision of whether to keep your Ether (and all other crypto) on an exchange vault versus in a private wallet comes down to the risks you’re trying to prevent - and who you trust.

What’s next?

Moonshot Alerts PRO has a lot more insights.

Here’s what you’ll get:

(📈PRO): How should you value Ethereum?

(📈PRO): Ethereum price prediction 🔮

(📈PRO): When should you sell your Ethereum?

(📈PRO): How much money should you allocate to Ethereum?

(📈PRO): The safest places to store Ethereum

(📈PRO): How to buy Ethereum directly in your brokerage account

(📈PRO): How to earn interest on your Ethereum (up to 30% per year)

(📈PRO): A group Q&A call with me to answer all your questions

(📈PRO): Access to the next edition of Moonshot Alert PRO included in your subscription (monthly) or all editions this year (yearly)