The only two investments that actually build wealth today

And why you should care about 20 million people partying online

Hello everyone - and happy Friday,

Every week, I write this newsletter hoping to guide you on a quest to find moonshots - 10x opportunities that radically move the needle in your life - so far, mostly in investing.

Today, however, I’ll let pictures do some of the talking.

If you’re wondering why I won’t shut up about crypto, the reason’s simple: it’s the only thing that matters right now.

Just like the Internet exploded over the last 25 years, crypto follows an exponential adoption curve that isn’t likely to stop anytime soon.

Imagine if you could have invested in the original email protocol or Google.

Today, you can.

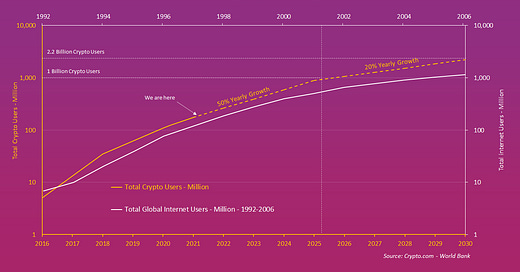

Take a look at this chart.

It reminds me of a quote by billionaire Mark Cuban, who sold his Internet company to Yahoo in 1999 for $5.7 billion:

“You only have to be right once.”

To be fair, we don’t have much of a choice.

Like I explained last week, inflation is here - and it’s much higher than you think.

Hell, even Coca-Cola is raising their prices to fight inflation.

Investing at 10% per year going forward just isn’t going to cut it.

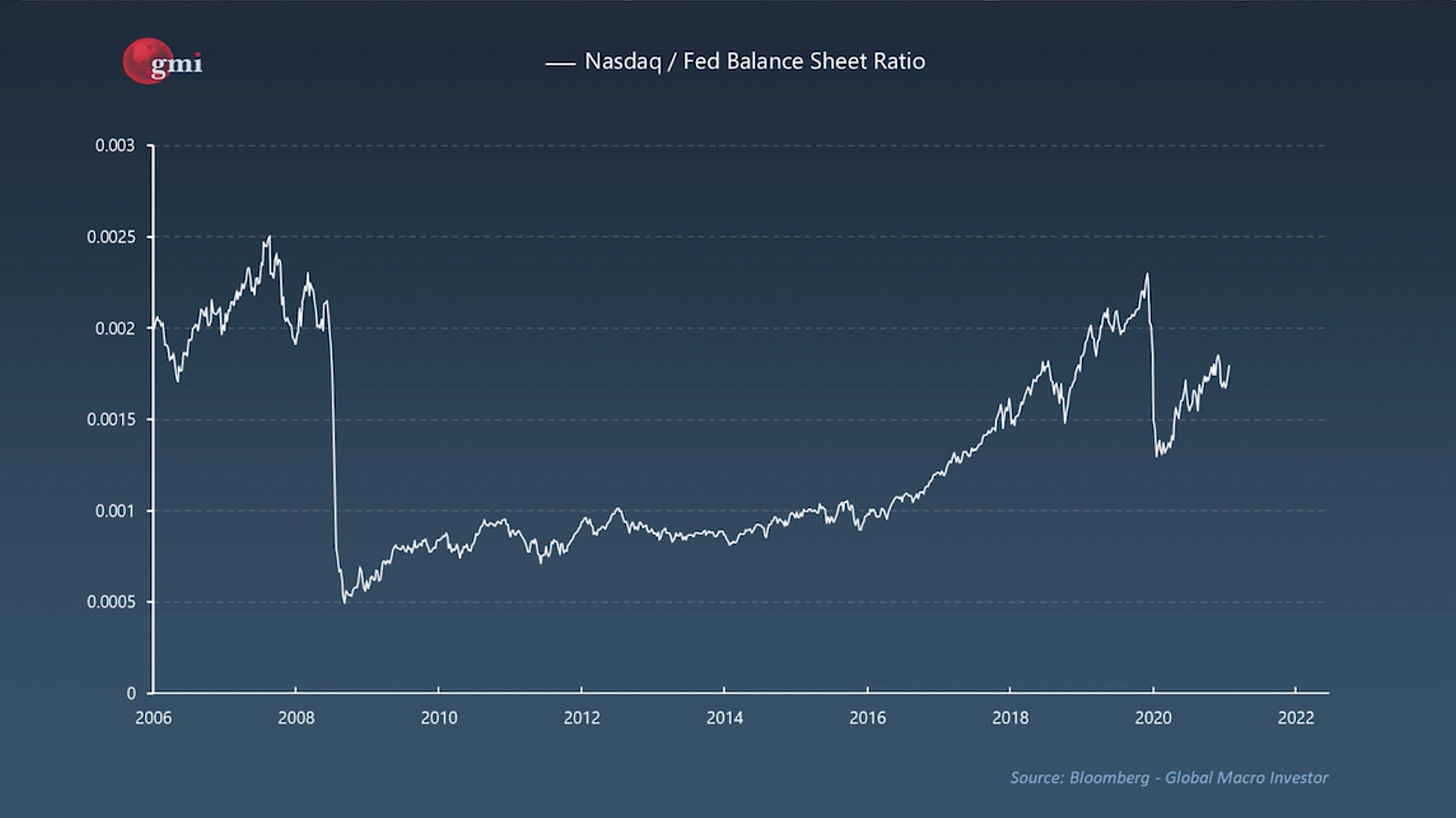

Even the traditional stock market isn’t outpacing inflation. In fact, it’s just enough to barely keep up:

There are only two assets that have outperformed the pace of monetary inflation.

Yes, you guessed it…

1) Bitcoin:

2) Technology stocks (after the 2008 crash)

Look - I don’t have some narrative like “stocks are overvalued”, “property is always safe”, “gold is insurance”, “your portfolio should be 60% stocks, 40% bonds” for which I desperately have to seek confirmation bias for you to keep reading.

I’m completely asset agnostic. I invest in - and write about - what works, not what I like or what I think you’re going to like or resonate with.

I don’t care that you and I might like stocks or real estate, because that’s what we’re familiar with.

The day crypto (or tech) becomes uninteresting, we move on. But right now, it’s the only game in town.

Crypto has roughly the same amount of users as the Internet had in 1997.

And crypto is growing much faster than the Internet did.

The next 4 years will bring the total crypto users to 1 billion - which is what the Internet accomplished in 10 years.

Despite the regular ups and downs (like today) - exponential assets revert to the exponential moving average - which is why, over the last 12 years, Bitcoin has only gone up.

Contrast that to silver. If you had bought silver in 1980, you’d still be down 50%.

Remember the investors analyzing horse carriage companies because they were blind to the automobile revolution?

Don’t be that person.

Rapid-Fire Best Insights of the Week

Book I bought this week: The 4th Turning. I’ve heard of this book more times than I can count, and last week when it was recommended by billionaire Jeff Gundlach, I finally pulled the trigger.

Best Tweet I came across:

It has never before in history been easier to make a lot of money. Don’t waste the opportunity.

Most insightful quote I read: “If 10 things are 90% likely to be a no, 1 of them will be a yes. So try all 10.”

Best video I watched this week: If you still think gold plays a role in your investment portfolio, listen to this interview.

Trend I’m paying attention to:

Virtual Reality - or more precisely, the Metaverse.

You’re going to be hearing about this a lot more going forward.

Do you remember the story of the NFT - in the form of digital art - that sold for $69 million?

Well, the buyer created a digital world with more digital art (on the Internet, of course) where you could go between online worlds to see different things and attend different parties.

There was live music with famous DJs - and 20 million people attended.

It won’t be long before you can:

put on a virtual reality headset

create an alternate avatar

live in an incredibly rich metaverse and earn money, exchange value, and build a community with others.

If you want to see what that could look like, check out this film trailer.

It won’t be all doom and gloom of course (thanks Hollywood, as always), but gamers and developers around the world are already creating worlds like these:

And quite frankly, the latest graphics are stunning:

I’ll be doing a deep dive soon into how exactly you can take advantage of developments in virtual reality.

I’ll cover how to invest in digital real estate, digital art, and a lot more.

Stay tuned.

Until next week,

Alex.