Moonshot Alert (PRO) #14: Solana 💎

-

Happy Friday everyone!

Two weeks ago, I wrote that we were likely in for the wildest crypto quarter ever.

A week later, bitcoin hit an all-time high of $66,930.

The quarter is just getting started.

If you haven’t already, I encourage you to read the previous Alert. It will shed light on some of the ways to minimze your losses and maximize your gains during these volatile times:

If you’re going to participate, one of the best ways is simply divide up a crypto portfolio between 50% bitcoin and 50% ethereum.

If you feel like taking on some more risk, however, you can.

Once in a while, there will be projects that deserve your attention and capital. The kind of project that deserves a 5-10% allocation in your crypto portfolio. Today is one of those.

These projects don’t come along every day.

But this one is worth your attention because:

it’s 20 times faster than Ethereum

can handle 25 times more transactions than VISA

it’s cheap

Could it be an Ethereum killer? maybe. I don’t have a crystal ball.

But an increasing number of crypto people are building applications on top of Solana instead of Ethereum.

By the way, if you’re not sure what Ethereum is, I recommend checking out the earlier alert on it. It will explain what Ethereum is, how it’s used - and also, where the price is likely to go):

Since I published the report, the price of Ethereum is up more than 150%.

But in the same time frame, Solana is up 600%.

And over the last 12 months, Solana is up 100X. That’s the kind of return that turns $10,000 into $1M.

In the process, Solana has become the 6th largest crypto currency in the world - worth $44 billion. That’s equivalent to the size of the Mariott Hotel chain or Walgreens.

Now, Ethereum is still my second-largest position after bitcoin. Solana doesn’t change that. But I believe Solana deserves an allocation.

As I wrote to you in the Ethereum report:

“If you wanted to allocate to various other cryptocurrencies, you could allocate:

45-50% to bitcoin

45-50% to Ethereum

10% to various other cryptocurrencies

If not, a simple portfolio consisting of 50% bitcoin and 50% Ethereum will likely do very well in the next decade.

Solana is part of the 10% of alternative cryptocurrencies that deserve your attention.

Note: I never recommend trading cryptocurrencies for short-term profits. I only invest in projects with a long-term horizon (5 years or more). Investing in nascent crypto projects is akin to angel investing - deploying small amounts of capital into promising projects with the aim of doubling down on the best ones.

For reference, I think about angel/early-stage crypto investing like this: I want to look at 200 projects, invest in 50 and double down on the 3 winners.

🚀 What is Solana?

Solana is a layer 1 blockchain like Ethereum and Bitcoin.

But unlike bitcoin - it isn’t intended to serve as digital gold. Instead, it operates like Ethereum. Other things are meant to be built on top of it.

What makes Solana different to Ethereum, however, is that it’s much cheaper and faster.

Eventually, Ethereum will undergo an upgrade to 2.0 that will radically increase the number of transactions it can handle per second - from 30 to 100,000. Until then, however, Solana is exponentially faster:

Whereas bitcoin can handle 7 transactions per second, Ethereum can handle 30 - and Solana can handle 65,000.

It’s cheap too.

It costs roughly $3 today to make a bitcoin transaction.

It costs anywhere from $10 to $50 on ethereum for a transaction.

On Solana, however, it costs just $0.0001.

Solana’s goal is “for a decentralized network of nodes to match the performance of a single node.”

That sounds complicated, but it’s actually simple. The want to re-create the speed and efficiency of centralized protocols (like stock exchanges) but on a decentralized blockchain.

To function, Solana uses Proof-of-Stake (similar to what Ethereum is upgrading to) and Proof-of-History - which, to keep it simple - is a way for transactions being verified without all the nodes needing to agree simultaneously.

But don’t worry - this Alert won’t get too technical. Here’s what you need to know.

🖼️ Why should you care?

Solana is a blockchain that’s giving competition to Ethereum. It’s particularly useful for transactions that need to be near-instatenous like an NFT purchase or investment trade.

The Metaverse, in which Mark Zuckerberg is pouring billions of dollars, will need fast and cheap transactions to facilitate interactions between people.

Can you imagine yourself standing in line of virtual Starbucks, paying $3 for a coffee PLUS $20 of fees and have to wait one minute for your transaction to go through?

Yeah, me neither.

To bring the next several billion people into crypto, the user experience will need to be smooth, fast and cheap. That’s what Solana is doing.

By the way, if you want a deep dive into what the Metaverse - the future of human interactions - will look like, check out this video:

And just like transactions on top of Ethereum require Ether (ETH) which drives demand, Solana developers and users will need to buy Solana coin (SOL) to use the protocols.

In their own words, Solana aims to be like blockchain at NASDAQ speed (NASDAQ is a stock excange in the US, similar to the New York Stock Exchange).

This is huge for institutions to come into crypto. Until now, decentralization has mostly meant slower, more expensive transactions (but secure and decentralized).

Solana solves this. It is faster and cheaper (but less secure).

It will allow decentralization to compete with centralization on speed and cost of transactions.

With a target ‘NASDAQ speed’, Solana specifically targets financial insititutions, who need instant, cheap transactions - but without the dozens of middle men that facilitate the transactions (and take a cut, of course).

Right now, NASDAQ handles roughly 500,000 transactions per second. For now, Solana is the only decentralized blockchain that can get remotely close to that.

And by building a direct competitor to centralized institutions not based purely on the narrative of decentralization - but on the proof of efficiency and lower costs - Solana attracts developers at startups and companies who would otherwise develop centralized products.

It’ll be a no-brainer, not for the sake of decentralization, but because the experience is better.

🧑💻 Solana is backed by the right people

As you probably know, there are thousands of cryptocurrencies out there, all touting to become the “next hot thing.”

But Solana is backed by some of the world’s most prominent early stage investment companies - including A16z and SBF - and has gained traction as a standout tool for NFT and Web3 game developers.

Degenerate Apes were one of the first major NFT projects to be built on Solana.

The Solana community is strong. The people behind Solana know that it is close to the best tech possible out there, and just like Bitcoin maximalists live and die for bitcoin, Solana has its share of die-hards.

The emergence of these die-hards fans has come alongside the rise of NFTs this year, which has propelled Solana into one of the most famous crypto projects in the world today (and the 6th largest by market capitalization).

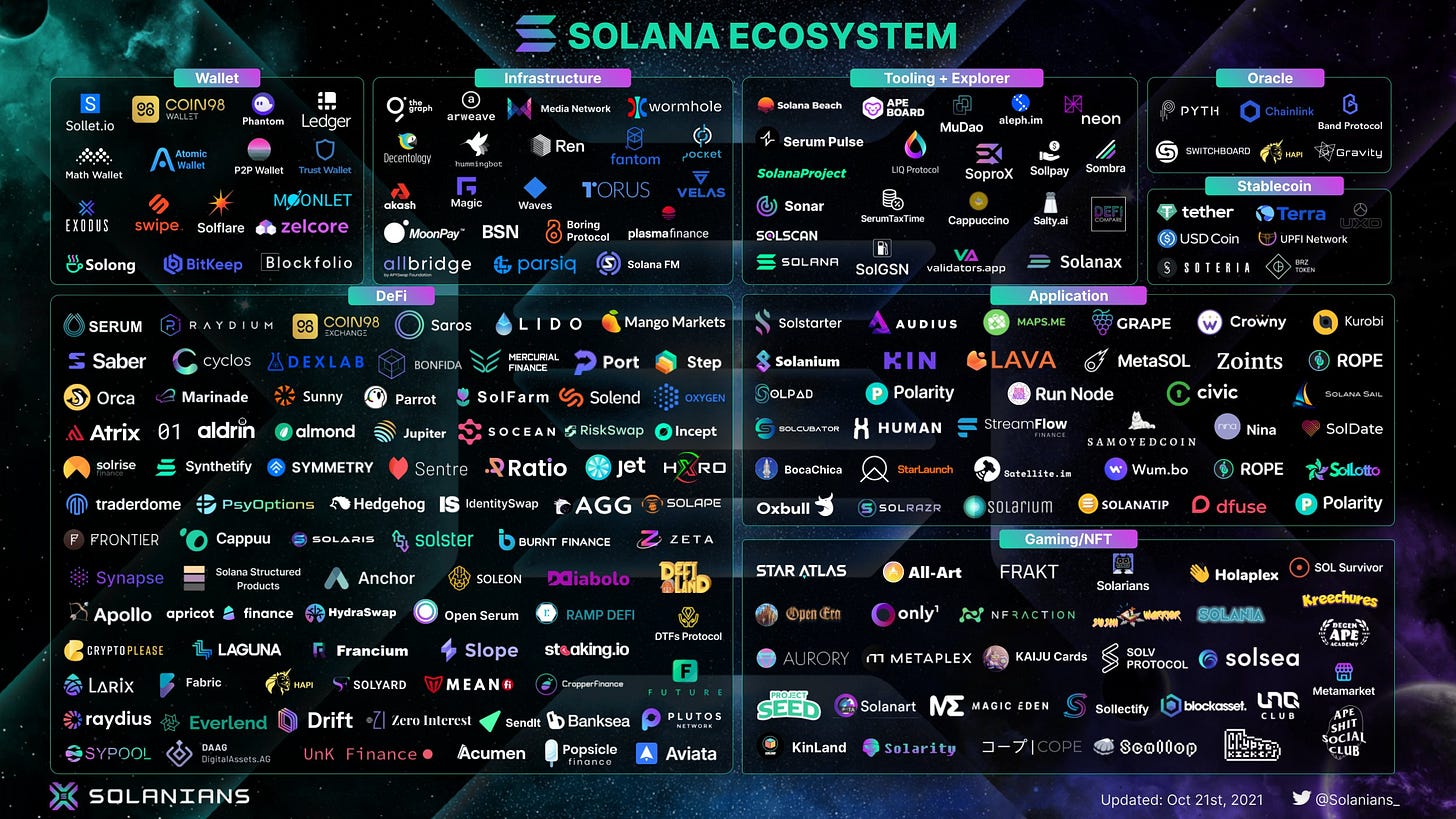

As a result, the Solana ecosystem is growing fast:

Solana will succeed if it can convince developers to build on Solana, and if these applications can attract a critical mass of users.

The success of NFTs has propelled Solana onto the world stage. But now, there are also games being built on Solana - games we can invest in.

These games use in-game NFTs, and I believe this market will be much bigger than most people expect.

Gaming as an industry is already much bigger than the entire film industry.

I’ll be making another alert soon on how to invest in gaming. So stay tuned.

📈 If it’s so great, why not go all-in on Solana?

Whether Solana survives or not is still up in their air. For now, it’s taking off at huge speeds.

But Solana is still new, and we’re in the middle of a strong bull market. A rising tide lifts all boats.

The upgrade to make Ethereum faster (Ethereum 2.0) could be delayed, which would result in Ethereum remaining slow and clunky for a while - and keep demand for Solana high and growing.

But if/when the entire crypto market turns sour, Solana’s momentum could be stopped dead in its tracks. Bitcoin would be the store of value winner as the crypto with the largest network effects, and Ethereum would likely be the default choice for developers.

The Ethereum ecosystem is much more mature than that of Solana - and its coding program (Solidity) is more approachable.

I see huge potential in Solana, but it’s still a nascent project. I treat Solana like I would a venture capital investment - one with 1x downside, but potentially 100x upside.

💰 How much capital am I allocating to Solana?

By chance, I bought Solana early in the spring. But even with the rapid increase in price, Solana still represents less than 3% of my total crypto portfolio.

I don’t recommend a larger than 10% allocation to Solana. 5% would be a good starting point.

We’ll re-visit this point in 6-months time when/if the current crypto cycle is over.

🔎 How to buy Solana

You can buy Solana on any of the major crypto exchanges - Coinbase, Binance etc. - so the picking is yours.

It is currently trading at $196.

🔗 Top resources to learn more

If you want to learn more about Solana, here are some resources for you to check out:

For a deeper dive on all things Web3 and crypto, I recommend you check out the latest Tim Ferriss podcast where he interviews Chris Dixon - a partner at Andreesen Horowitz, an early investor in Solana.

Until then, happy investing.

Alex.

Check out the other Moonshot PRO Alerts here…

Disclaimer: This is not investment advice. I have no idea what will happen in the short- or long term. I own Solana. This is for educational and entertainment purposes only. Do your own diligence before you invest.